| This post contains affiliate links. As an Amazon associate, I earn from qualifying purchases. |

Are you like many of my friends who sign up for the Chase Sapphire Preferred, spend and enjoy the points, but then aren’t sure what your next steps should be?

Don’t worry, I’m here to help!

If you have a partner/spouse, refer them to your card. (If not, continue to step 2!)

If you have a partner, create a Chase referral link for your card and have them sign up through your link. You will receive 10,000 points and they will receive their 60,000 point bonus after meeting their minimum spending requirement.

After they receive the bonus, you can combine your points within your household using the Chase Combine Points feature in your Chase online banking tool. You’ll need to call Chase customer service the first time you combine points, but after that the online banking tool will save your information.

Combining points allows you to strategically transfer your points to partners like United and Hyatt to book the flights and hotels you prefer.

Understand Chase’s 5/24 rule

Most travel bloggers recommend beginning with Chase cards. This is because Chase is the pickiest bank about approving credit card applications. They won’t approve you for a card if you have already been approved for five cards in the last 24 months (5/24 rule).

Identify your travel goals

Do you want to travel to the Caribbean? to Europe? within the USA? What do you value more – flights or hotels? Do you have a specific airline hub nearby? For my family, we wanted to spend our points and miles mostly on flights and use Airbnbs for our lodging. Another family might prefer all-inclusive resorts. The possibilities are many!

Recommended next cards

The four card families I would recommend as next options are the Freedom, United, Southwest, and Hyatt cards.

These are great options because the Freedom earns Ultimate Rewards points, and the other three accept Ultimate Rewards through transfer, so you can easily top off your point supply, if needed. Essentially, wherever you run short, your Ultimate Rewards will have you covered.

Freedom Unlimited

The Freedom Unlimited is a great complement to the Sapphire Preferred. It’s a no-annual fee card that is typically used for cash-back. When paired with the Sapphire Preferred, it earns Ultimate Rewards which can be transferred to your Sapphire for booking.

While the Sapphire earns 2x points on travel and 3x on restaurants, the Freedom Unlimited gives you 1.5x earning power on everything else. This especially comes in handy when you have a large expense like a home or car repair.

United Cards

United is so easy to use and offers consistent value in travel, especially within the USA and to Europe. One of the things I like best about United is that it’s possible to fly internationally into and out of regional airports without breaking the bank.

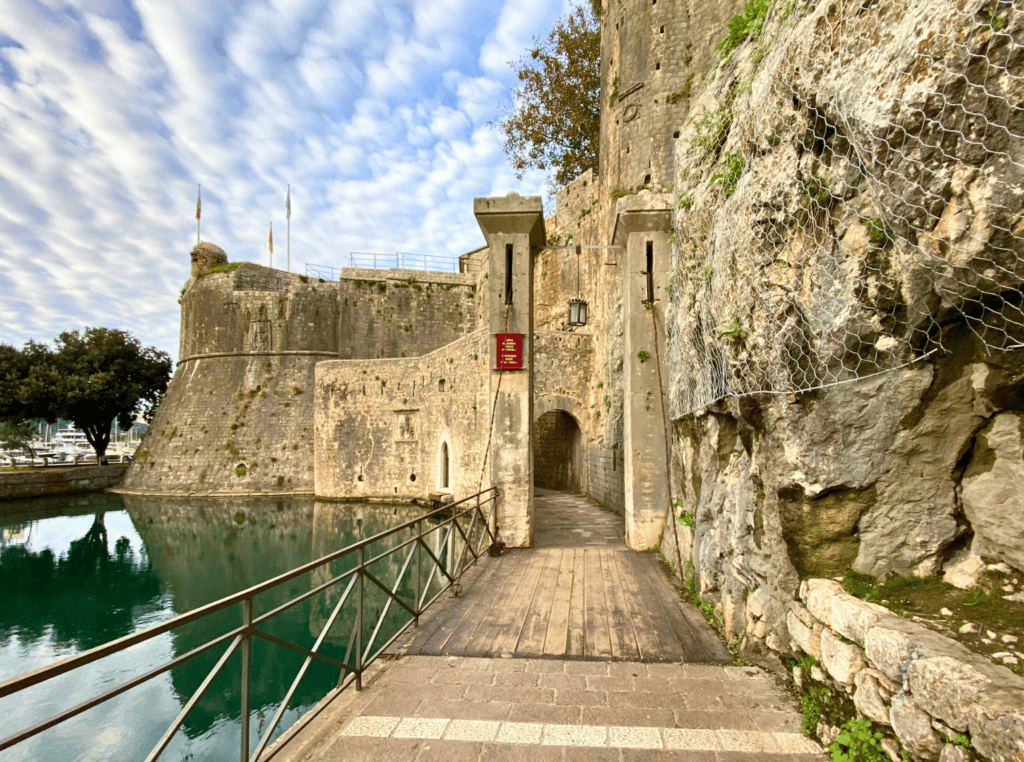

Our closest home airport is the Eastern Iowa Airport. Before booking with points and miles, we would drive 3 1/2 hours to Chicago or Minneapolis for a better flight price. When booking with miles, the cost to travel between smaller airports can often be quite reasonable. We used United miles to fly from Podgorica, Montenegro (small airport) to the Eastern Iowa Airport (another small airport) last summer. This saved us the considerable hassle of a long drive at the start and end of the journey.

Which United card is best for you?

United Explorer Card

For most people, the answer is the United Explorer card. The annual fee is waived for the first year of membership, and after that it is only $95/year. It comes with a 50,000 point sign-up bonus after spending $3,000 in three months. Additional benefits include a free first checked bag, priority boarding, and two United Club passes each year.

United Quest Card

If you’re looking for a card with a few more benefits and a larger sign-up bonus, the United Quest could be for you. It offers a 60,000 point sign-up bonus after spending $4,000 in the first three months. The annual fee is higher, at $250/year. If you’re considering getting Global Entry or TSA PreCheck, the Quest card reimburses the application fee up to $100. Additional benefits include $125 annual United purchase credit, free first and second checked bag, and priority boarding.

United Club Infinite Card

This card is best for frequent travelers who place a high importance on access to United Clubs. It comes with an 80,000 point sign-up bonus after spending $5,000 in the first three months. The annual fee is $525, but it comes with a year of access to the United Clubs, free first and second checked bags, and premier access.

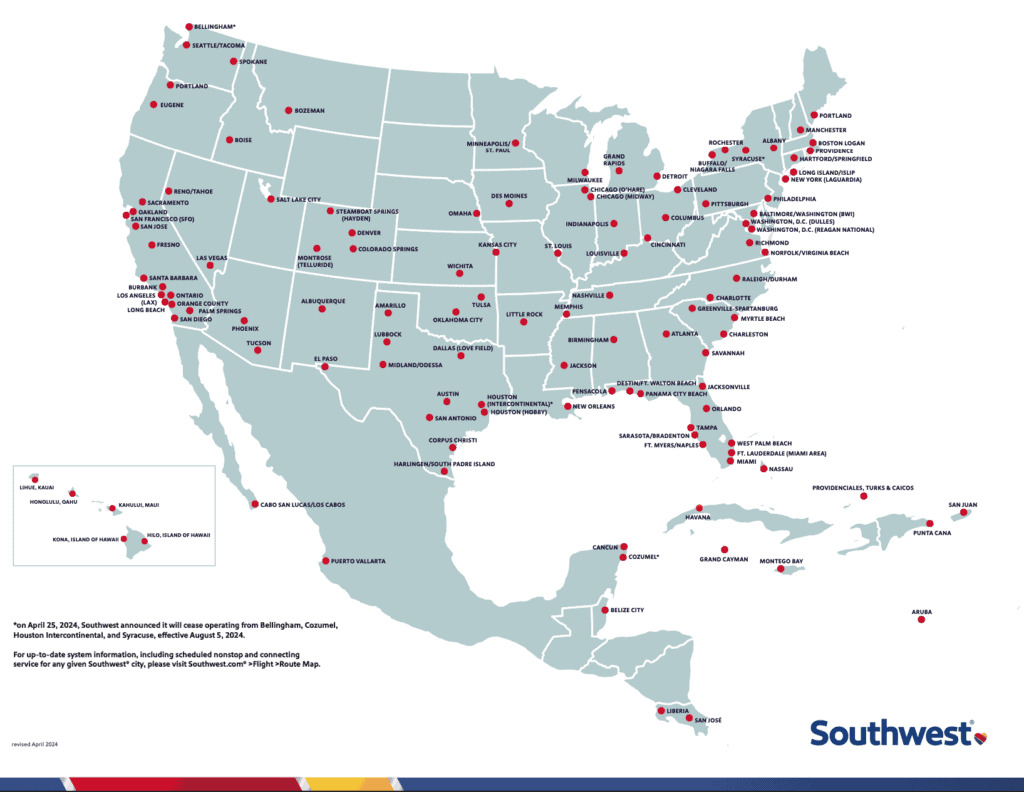

Southwest cards

Southwest offers great deals within the USA and to Mexico and the Caribbean, but does not fly to Europe. Unlike most points and miles programs, Southwest points are completely based on the actual price of the flight. There is not a separate system for pricing flights with miles.

Companion Pass

One of the big perks of Southwest cards is the ability to earn a companion pass through Southwest. When you earn 135,000 points in one year, you earn a companion pass, which means a companion can fly with you for free on any Southwest flight during the year. Depending on how often you fly, this benefit can really add up!

Which Southwest card is best for you?

Southwest Rapid Rewards Plus

The Rapid Rewards Plus card has the lowest annual fee at just $69. You’ll earn 50,000 points after spending just $1,000 in the first three months. You’ll receive 3,000 points every year on your cardmember anniversary, 2 EarlyBird check-ins per year, 25% back on inflight purchases, and 10,000 Companion Pass qualifying points to boost your points total each year.

Southwest Rapid Rewards Priority

The Rapid Rewards Priority also offers a 50,000 point sign-up bonus, but it comes with a few more benefits and a higher annual fee of $149. With this card, you’ll earn 7,500 points every year on your cardmember anniversary, $75 in annual travel credit on Southwest, and 4 upgraded boardings per year.

Hyatt Card

Hyatt offers fantastic value in hotel stays. Category 1 nights are available for as little as 3,500 points per night. Although the Hyatt card’s sign-up bonus is a bit low, it comes with other perks.

Status

One big perk is the automatic Discoverist status for card members. Discoverists get priority for early check-in and late check-out. They get free bottles of water from the front desk, which can come in handy. They also have access to their preferred room within the category booked. Every once in a while, a property goes all out and does something special like this cheesecake I found in my room at the Hyatt Regency in Mérida, Mexico! So thoughtful!

Free Night Award

Another big perk is the Category 1-4 free night award after each cardmember anniversary. Although the annual fee is $95, I plan to keep this card indefinitely because of the value I get from the free night award. When the Chicago Athletic Association was a Category 4 hotel (now a Category 5) we booked it during the Lollapalooza Music Festival. The going rate was $550/night, but we were able to book with our certificate and save a significant amount of money. There are so many Category 4 hotels to check out with your annual free night.

Refer others

For each card that you have, check the referral page to generate links for others. Referring your own partner/spouse is completely allowed and fine to do. You will also generate points and miles by referring friends and family members.

Pay your balance in full each month

People often ask me if opening so many credit cards has hurt our credit score. Our credit has actually gone up a bit since beginning our points and miles journey. As long as you pay your cards off each month, you won’t have a problem. If you can’t quite pay them in full, make sure to keep up with your minimum balances.

Spend time using the booking websites

If you aren’t sure which card to get, start looking for some flights on United and Southwest. Be sure to check the box to search with miles or points. See what you find and how many points it would take to book the flights you are interested in. Start looking at Hyatt’s available hotels and how many points they cost to book. The more you know about booking, the easier it will be to decide on next steps.

When you exhaust Chase options, move on to other programs

One of my favorite airline programs is Aadvantage – especially for flights to Mexico, Central America, and the Caribbean! Barclays has an Aadvantage card with a minimum spend of only one purchase!

American Express, Citi Thank You Points, and Capital One all have fantastic programs too.

Remember it’s a marathon, not a sprint

Credit card companies can get suspicious if you quickly open a large number of cards. Remember, you want to be in this for the long haul. There are SO many different programs and credit card options. I’ve been traveling with points and miles for six years and haven’t come close to using all of them.

Six years ago I wondered if this type of travel was sustainable. I assumed I would run out of cards and options. That hasn’t been the case at all. Also – many cards allow you to cancel and reapply after 2-4 years!

Get excited!

This really works. I’m a teacher from Iowa married to another teacher and I’ve taken multiple domestic and international trips every year since getting started. Sometimes I travel alone or with a friend and sometimes I travel with my family. Understanding the world of points and miles has made everything from short weekend trips to multi-week international vacations a regular part of my life.

I am so grateful I was brave enough to get started. You can do it too! Feel free to reach out on the contact page if you need any help!