| This post contains affiliate links. As an Amazon associate, I earn from qualifying purchases. |

Feeling intimidated by the minimum spending requirement on most credit card offers? I have a great card for you.

I often hear from friends who worry they don’t spend enough in three months to qualify for credit card sign up bonuses. For example, in order to receive the bonus from the Chase Sapphire Preferred, you must spend $4,000 in three months on the card. For people with low monthly expenses, this can be a challenge.

Luckily, there’s a card that only requires one purchase and payment of the annual fee ($99) to receive the bonus. It’s the Barclays Aadvantage Aviator card.

That’s right – you can use it to buy a coffee – and that’s it! Just wait for the credit card statement, pay it when it arrives, and about a month later you’ll have your miles!

The sign-up bonus changes periodically (currently 60k Aadvantage miles through this link) but those miles can take you a long way!

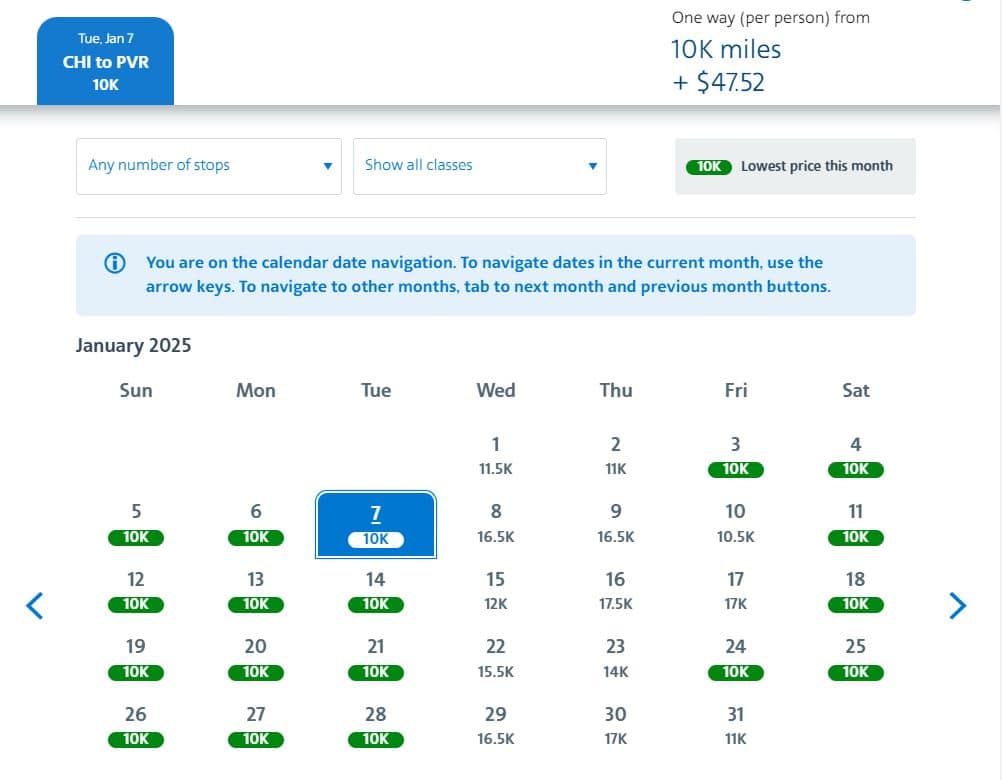

For example, if you’re looking to escape the Midwest winter next January, AA has a variety of dates available from Chicago to Puerto Vallarta for only 10k Aadvantage miles (one way).

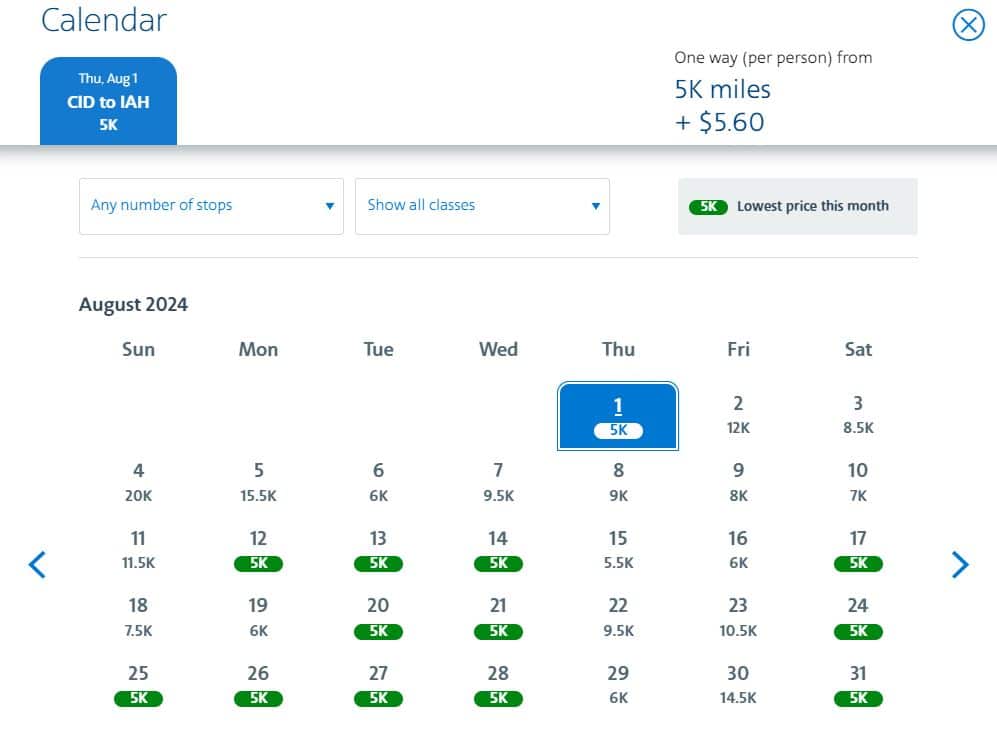

As someone who lives 3-4 hours from the nearest airline hubs, I love that American offers great deals from regional airports. For example, I can fly from Cedar Rapids, Iowa to Houston, Texas to visit my sister there for only 5k miles one way. Depending on the dates I choose, this means a round trip ticket from Iowa to Houston would only use 1/6 of the sign up bonus for this card.

Although it’s a good idea to start with Chase cards because of their 5/24 rule, if you are intimidated by meeting the spending requirements, this card is a great way to dip your toes in the world of award travel.

We recently used one sign up bonus from this card to book four one way tickets from Cedar Rapids, Iowa to Lima, Peru this July. I’ve been looking forward to that trip all school year!

When can I cancel the card?

You must keep the card for a year and pay the annual fee in the first month to receive the bonus. I suggest adding a reminder to your calendar to cancel the card in a year. Once the second annual fee posts to your account, you can cancel and the second fee will be refunded.

Will it hurt my credit?

As long as you keep the card for a year, you won’t have a problem. We’ve been applying for new cards and canceling many after a year for the last six years. Our credit has actually gone up a bit since we started.

How long until I can apply again?

You can get this card again two years after your last bonus. Both my husband and I have received the bonus multiple times over the last six years. You’re essentially exchanging $99 for 60k Aadvantage miles. As you can see from the examples above, 60k Aadvantage miles can get you six round trip domestic tickets, two round trip tickets to Mexico, and in some cases can even score you a round trip ticket to Europe! Not bad for $99.

Final thoughts

If you’re interested in getting started with points and miles, but finding the Sapphire Preferred’s minimum spending requirements to be intimidating, take a look at the Barclays Aadvantage Aviator. You could be spending your new miles in a little over a month!