| This post contains affiliate links. As an Amazon associate, I earn from qualifying purchases. |

Using points and miles to travel sounds a little too good to be true, right? When I first heard about it, I figured there had to be some kind of catch.

To a certain extent, there is. The catch is that it’s not completely free. There are annual fees on credit cards and there are taxes and fees on flights.

But it’s still SO much cheaper than buying a flight or hotel room with cash.

Here are a few of the most common questions and comments I’ve heard over the years.

Does opening and closing new cards hurt your credit?

Not if you pay your balance in full each month and keep each card for at least a year. Our credit has actually gone up by ten or fifteen points since we started.

Instead of closing a card after a year, you can often downgrade the card to one with no annual fee. This looks better to credit reporting agencies than a closure.

Can I just get one card and stick with it?

You can, but the big rewards come from sign-up bonuses. If you don’t want to mess with opening and closing cards, you can use the Chase Freedom Unlimited for everyday spending (1.5 points per dollar) in combination with the Sapphire Preferred for meals out (3x points) and travel (2x points). You can combine the Ultimate Rewards earned from both cards. The Freedom Unlimited alone is a cash back card with no annual fee, but if you also have the Sapphire, you can earn points instead of cash.

What about luxury travel?

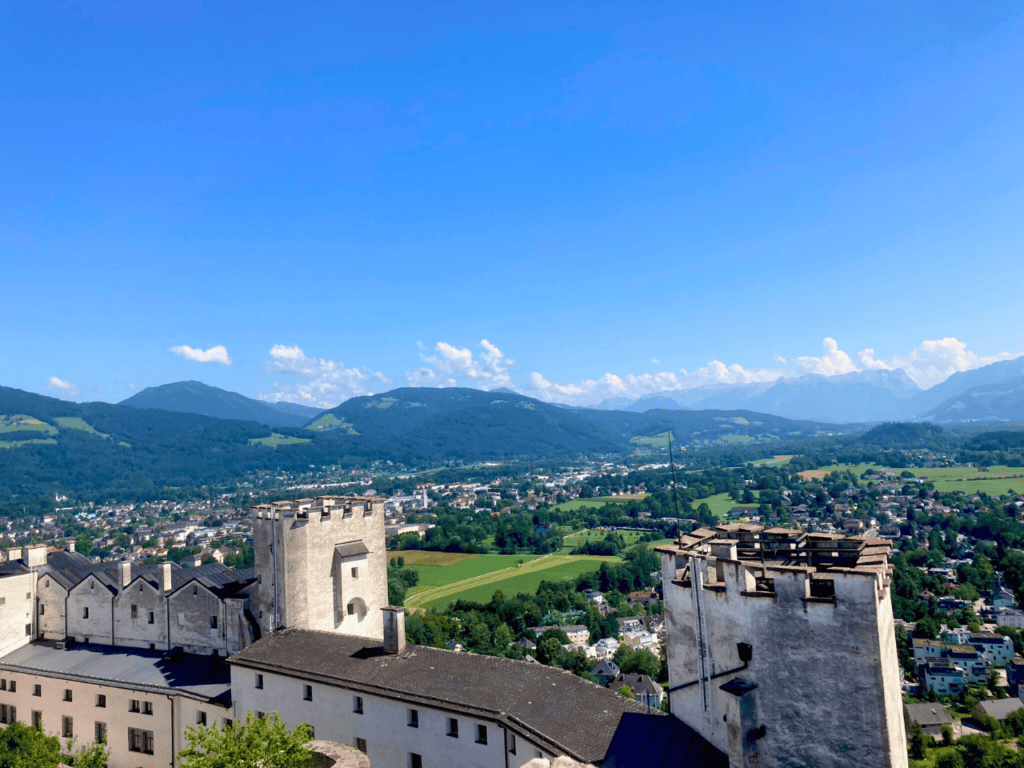

Many of the award travel influencers show themselves traveling business class or first class on a regular basis. You absolutely can use points and miles to travel in luxury. It just takes a lot of regular spending or sign-up bonuses.

If you have a business where you buy inventory or have large expenses every month, you should be earning points on all of that money spent. With large amounts of spending to earn the points, luxury travel is very accessible. Chase has a wide variety of business cards available.

We don’t spend enough money to use our points on luxury travel. We want to take as many trips as possible with our kids, so we use our points for economy seats.

Do you run out of cards to sign up for?

It’s possible, but it hasn’t happened to us. There are so many different cards and programs available. Remember to start with the Chase cards because of their 5/24 rule. After that, there are plenty of other banks, cards, and programs to explore.

Keep in mind that many cards allow you to cancel and reapply. For example, the Barclays Aadvantage Aviator card allows you to reapply and receive the bonus two years after your previous bonus. My husband and I have both gotten that card twice now and probably will again soon.

How do I find flights?

You just have to spend the time looking around at different programs. There’s no easy one-stop shop.

For example, I usually have a mental list of possible travel locations. We’re interested in a future trip to the Baltic countries and we’re also looking at a Bulgaria/Romania trip or a Poland trip. This fall, I’ll start checking Virgin Atlantic, American, and United for summer award flights to these places. If I find great flights to one and not the others, that helps determine our next trip. If I don’t find flights to any of them, I’ll consider other destinations. I explain more about letting your travel destination choose you here.

Which card should I start with?

I recommend the Chase Sapphire Preferred, because it’s a great value and very easy to use. You can read more about getting started in this post.

What if I don’t spend very much money?

There is typically a minimum spending requirement during the first 3-6 months in order to receive the bonus. If those spending requirements are daunting, there’s a card that only requires one purchase. Here’s more info about the best card for people who don’t spend much money.

What if my credit score is low?

Most travel credit cards require a score of around 700 or higher to qualify. If you have a lower credit score, you’ll need to work on that before applying.

How do you keep track of it all?

I keep a spreadsheet of when we opened and closed cards. All of our Chase cards are grouped together in the online portal, so it’s easy to pay them. If we’re completing a spending requirement for a different card, I just log in and pay it once a month. It’s not as difficult as it seems.

Credit cards are dangerous. They lead to debt.

That’s fine. If it doesn’t work for you, it’s your decision.

We feel comfortable using them because we pay the balance in full each month, so we don’t spend money on interest or build up a balance.

This sounds like too much work.

It takes some work and it takes some time, but it’s absolutely worth it to me. You’ll have to decide for yourself if it’s worth it to you, depending on how much you like to travel and how much extra money you have to spend on it.

What did I miss?

Let me know if there’s a question you have that I didn’t address. Here’s a link to the contact form.

Happy travels!